ad valorem tax florida statute

Name Spouses name Tax Year 20 Building name Apt. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

9 Tips For Buying A Vacation Home Sarasota Real Estate Vacation Home Real Estate Tips

ADDITIONAL AD VALOREM TAX MILLAGE TO BE USED FOR SCHOOL FOR FOUR YEARS.

. Whether to increase an ad valorem millage by one 10 mill for a period of four 4 years. Section 163387 Fla. Special Assessments Versus Ad Valorem Property Taxes as Local Government Revenue Sources.

Florida Statutes Definitions Index 2021 PDF General. The taxes are assessed on a calendar year from Jan through Dec 365 days. An ad valorem tax or non-ad valorem assessment including a tax or assessment imposed by a county municipality special district or water management district may not be assessed.

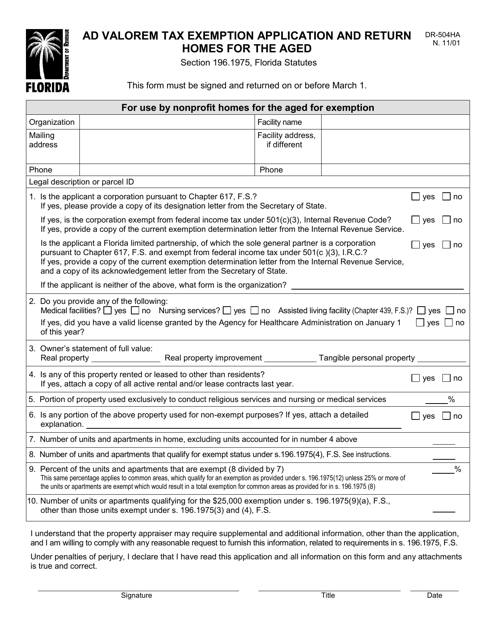

HOMES FOR THE AGED. Section 1961975 Florida Statutes. 1 ad valorem taxes.

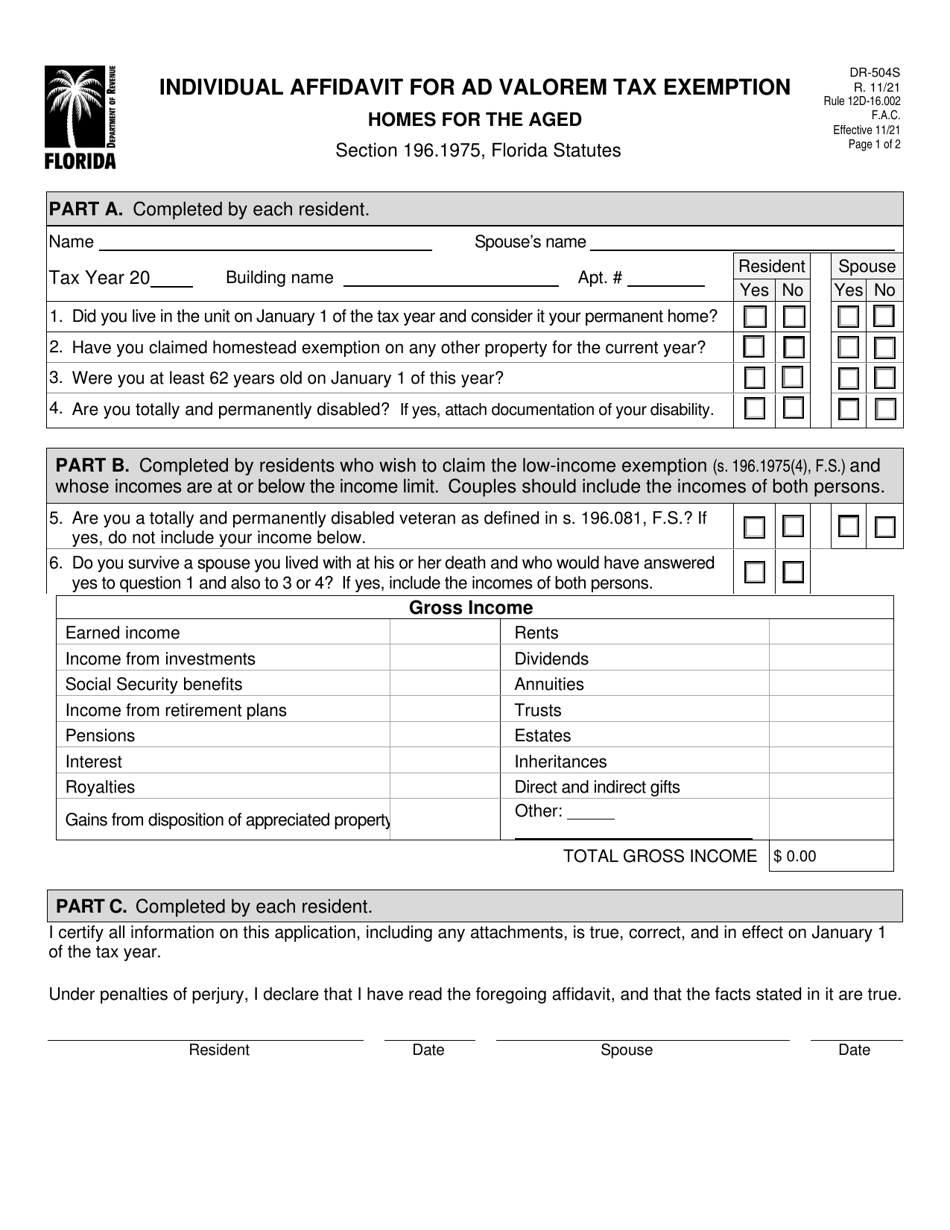

Proof should be provided from the Veterans Administration. Resident Spouse Yes No Yes No 1. Finally it predicts future implications for the efficient use of the property appraisers database in light of Morris.

1 Ad valorem taxes and non-ad valorem assessments shall be assessed against the lots within a platted residential subdivision and not upon the subdivision property as a whole. Florida Statutes 194301 Challenge to ad valorem tax assessment. Body authorized by law to impose ad valorem taxes.

1 Ad valorem taxes and non-ad valorem assessments shall be assessed against the lots within a platted residential subdivision and not upon the subdivision property as a whole. Florida Statutes operational expenses to be funded by proceeds of the Millage shall be for. FL Taxpayers Ad Valorem Property Tax Exemption Upheld.

The exemption was imple- mented to support economic growth and enhance the countys ability to. Ad valorem tax exemptions for historic properties. 5000 Veteran Partial Disability Florida Statute 196012 19610114 Any permanent Florida resident who is an honorably discharged veteran disabled to a degree of 10 or more is entitled to this exemption.

1a Any real estate that is owned and used as a homestead by a veteran who was honorably discharged with a service-connected total and permanent disability and for whom a letter from the United States Government or United States Department of Veterans Affairs or its predecessor has been issued certifying that the veteran is totally and permanently disabled is exempt from. Additional ad valorem tax exemptions for historic properties open to the public. Completed by each resident.

Section 163385 Florida Statutes. Community redevelopment agencies created after July 1 2002 are limited to 40 years. Effective 1121 Page 1 of 2 INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION HOMES FOR THE AGED Section 1961975 Florida Statutes PART ACompleted by each resident.

45 in the Florida Supreme Courts Morris decision. An ad valorem tax levied by the board for operating. The actual amount of the taxes is 477965.

Annually an ad valorem tax of not exceeding 1½ mills may be levied upon all property in the county which shall be levied and collected as other county taxes are levied and collected. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION. An ad valorem tax or non-ad valorem assessment including a tax or assessment imposed by a county municipality special district or water management district may not be assessed separately.

1 In any administrative or judicial action in which a taxpayer challenges an ad valorem tax assessment of value the property appraisers assessment is presumed correct if the appraiser proves by a preponderance of the evidence that the assessment was arrived at by complying with s. Rule 12D-16002 Florida Administrative Code Effective 1112 INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION HOMES FOR THE AGED Section 1961975 Florida Statutes PART ACompleted by each resident. Check all that apply.

Lets look at the 2015 Ad Valorem taxes in detail. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements. THE LAW GOVERNING SPECIAL ASSESSMENTS IN FLORIDA A.

Name Spouses name. An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation bonds of the district and to provide for any sinking or other funds established in connection with such bonds. To pay the principal of and interest on any general obligation bonds of the district.

Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day. Name Spouses name Tax Year 20. Florida Property Appraisers notoriously can change their mind when it comes to exemptions even when those exemptions have been in place for years prior.

Ad Valorem Tax Escambia County FL Explained. 472 Stetson Law Review Vol. An ad valorem tax levied by the board for operating purposes exclusive of debt service on bonds shall not exceed 3 mills except that a district authorized by a local general-purpose government to exercise one or more powers specified in s.

Recently Alachua County denied a longstanding exemption from the Gainesville Area Chamber of Commerce which had been previously. Provides for a limitation of the pledge of tax increment financing for a term of 30 years after the community redevelopment plan is adopted or amended up to a maximum of 60 years. Section 125016 Florida Statutes is a general grant to counties of the authority to impose an ad valorem tax and provides in full.

Ad valorem tax exemptions are available in florida for projects i wholly owned by a nonprofit entity that is a corporation not-for-profit or its wholly owned subsidiary qualified as charitable under section 501 c 3 of the internal revenue code and in compliance with other requirements the nonprofit exemption under florida statutes. An elected board shall have the power to levy and assess an ad valorem tax on all the taxable property in the district to construct operate and maintain assessable improvements. 11 Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows.

Millage may apply to a single levy of taxes or to the cumulative of all levies. And to provide for any sinking or other funds established in connection with any such bonds. Florida Administrative Code.

The Polk County Economic Development Ad Valorem Tax Exemption Exemption is an exemption of taxes to encourage quality job growth in targeted high value added businesses. 196198 1962001 1962002 Florida Statutes This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are organized and operate for one or more of the following purposes. 1900122 may levy an additional 2 mills for operating purposes exclusive of debt service on bonds.

Home Laws 2018 Florida Statutes Title XIV Chapter 196. 10 Mill means one onethousandth of a - United States dollar.

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Florida S State And Local Taxes Rank 48th For Fairness

Florida Dept Of Revenue Property Tax Taxpayers Exemptions Filing Taxes Property Tax Revenue

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return Homes For The Aged Florida Templateroller

Florida Real Estate Taxes What You Need To Know

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes 2011 Templateroller

Florida Dept Of Revenue Child Support Program Child Support Supportive Child Support Laws

January Is Property Tax Month In Most States Property Tax Florida Real Estate Property

Pin By J Elizabeth On 501 C 3 Charitable Organizations Guide Fl Charitable Organizations Public Information Organizing Guide

Pin By J Elizabeth On 501 C 3 Charitable Organizations Guide Fl Tax App Charitable Organizations Organizing Guide

Broward County Florida Security Deposit Law Florida Law Broward County Florida Broward County

Quit Claim Deeds Corporate Home Ownership And The Homestead Exemption Property Tax Adjustments Appeals P A In 2021 Home Ownership Homestead Property Property Tax

Which Maintenance Expenses Can Be Deducted On Rental Property For Tax Deduction Diy Decor Rental Property Home

Florida Revenue Floridarevenue Twitter Disaster Preparedness Hurricane Prep Preparedness

Florida Dept Of Revenue Nonprofit Org Parents As Teachers Teacher Organization Parent Teacher Association

Pin By Claudia De Lillo On School Back To School Back To School Sales Holiday Items Back To School

Form Dr 504s Download Fillable Pdf Or Fill Online Individual Affidavit For Ad Valorem Tax Exemption Homes For The Aged 2021 Templateroller